What is a Bull Call Spread

A Bull Call Spread is a low-risk options strategy used when you believe a stock or index will go up moderately. Instead of buying a single call option (which is expensive), you buy one call option at a lower strike price and sell another call option at a higher strike price of the same expiry. This helps you reduce your cost while also capping your profit and loss.

Imagine this like:

- You pay to bet the market will go up

- But you also get paid by someone else who thinks it won’t go up too much

Benefits:

- Lower cost than buying a single call

- Limited risk

- Ideal for moderately bullish markets

When Should You Use a Bull Call Spread?

- You expect a moderate upmove in the index or stock

- You want defined risk and reward

- You prefer low-cost option strategies

Entry and exit strategy

When to Enter:

- When you identify a support level or bullish breakout

- Typically when IV is low, and premiums are cheaper

- Best executed early in the expiry week to get maximum time value benefit

When to Exit:

- When the price nears the upper strike (your sold call)

- Or when your defined target profit or stop-loss hits

- Use OptionX's P&L tracker to monitor live exits easily

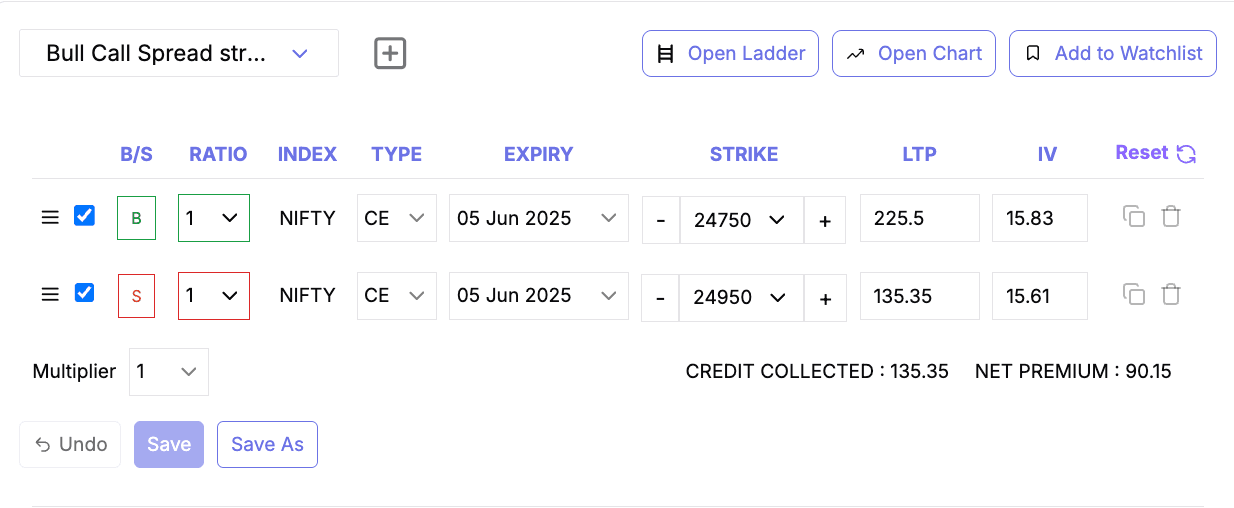

Example: Bull Call Spread with NIFTY (Jun 05, 2025 Expiry)

Let’s see how you can use a real Bull Call Spread example on OptionX to take advantage of a moderately bullish view on NIFTY.

Strategy Setup:

Instrument: NIFTY

Expiry: 05 June 2025

Type: Call Options

View: Moderately Bullish

You believe NIFTY will move up in the next few days but not drastically.

Why This Strike Pair?

We’re Buying the 24750 CE and Selling the 24950 CE:

- You buy 24750 CE because it's close to current price and likely to go ITM (in the money)

- You sell 24950 CE to reduce cost, since you don’t expect NIFTY to move far beyond 24950 in the short term

IVs (Implied Volatility) are balanced, meaning there’s no abnormal premium skew—ideal for setting up this strategy

Why These Numbers Matter

- Max Profit ₹8,238.75: If NIFTY expires at or above 24950, this is what you’ll earn.

- Max Loss ₹6,761.25: Even if the market falls, your loss is capped — unlike naked options.

- Breakeven Point ₹24,840.15: That’s where your P&L turns positive.

- Risk/Reward Ratio 0.82: You’re risking ₹1 to potentially make ₹1.22 — a fair trade in a sideways-to-bullish market.

- Funds Needed ₹44,102.40: This is the margin + premium required to execute this strategy.

- POP (Probability of Profit) 45%: Decent odds, especially if your analysis aligns with the market direction.

Place Bull Call Spread Order in 3 Steps

Step 1: Go to OptionX and Open the Strategy Builder

- Log in to your OptionX account

- From the main dashboard, click on Strategy Builder

Step 2: Select Bull call spread and save it

Step 3: Open Ladder

Step 4: Place Bull Call Spread order

- Select Order type and Quantity

- Click on the buy column to place the order

Pro Tip 💡

- Use Bracket Orders or Cover Orders for safer exits

- Enable Auto SL Trail for dynamic risk protection

- Add the strategy to your watchlist for easy monitoring

TL;DR: Bull Call Spread in a Nutshell

- What: Buy a call option at a lower strike and sell another call at a higher strike with the same expiry.

- Why: Reduces cost and limits risk compared to buying a single call option.

- When: Use when you expect a moderate rise in the stock or index.

- Risk: Limited to the net premium paid (~₹6,761).

- Reward: Limited profit potential (~₹8,238) if price rises above the higher strike.

- Breakeven: Price at which you start making money (~₹24,840).

- How to Exit: When the price nears the sold call strike or when the target profit/stop-loss is hit.

- Tools: Use OptionX’s Strategy Builder and P&L Tracker for easy setup and monitoring.

Final Thoughts

With limited risk, a decent reward, and clear breakeven visibility — it’s a solid choice for directional traders.

OptionX Tip: Use the P&L Tracker inside OptionX to monitor your live returns, breakeven, and strategy health — so you never miss an exit!