What is Paper Trading?

Paper trading is the process of simulating real trading without using actual money. It allows you to practice buying and selling financial instruments like stocks, options, or futures using virtual funds, often through a trading platform that mimics live market conditions.

Why Paper Trading on OptionX?

- Unlimited Practice: No restrictions on the number of trades.

- Fast Execution: Trade using a lightning-fast price ladder.

- Easy to Learn: Beginner-friendly interface and guided workflows.

- Auto SL Trailing: One-click trailing stop loss built-in for risk management.

- Drag & Drop Orders: Modify orders directly on the ladder.

Step-by-Step: How to Place Your First Paper Trade

Options trading involves complex instruments with time decay, volatility, and multiple moving parts. Paper trading helps you:

- Understand how strike prices, premiums, and expiration dates work.

- Practice entry and exit timing with no consequences.

- Build confidence before risking real capital.

1. Login to OptionX Platform

Step 1: Head over to OptionX and log in to your account

Step 2: Not Ready to Trade Live? No worries! You have two options:

1. Enable Paper Trading – Practice unlimited risk-free with virtual trades.

2. Connect to Your Broker – Follow our Broker Integration Guide to start live trading.

2. Price Ladder

Step 1: Go to the Widgets section.

Step 2: Click on Price Ladder.

Step 3: Type and select your Preferred Index (NIFTY 50) from the list.

Step 4: Price Ladder will be Opened for ATM (Eg. NIFTY 24 APR 2025 24150 CE)

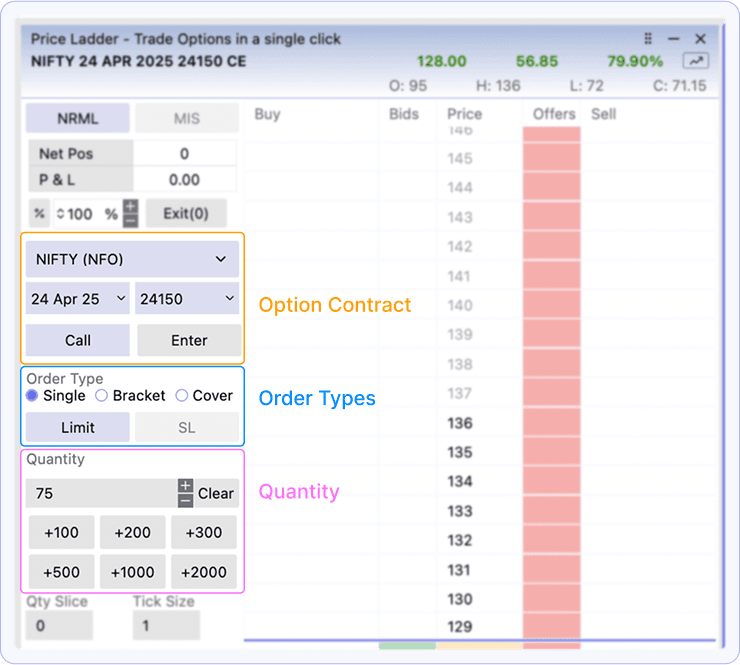

3. Order Entry Panel

When the Price Ladder opens, it comes pre-filled with:

Options Contract: ATM NIFTY50 24 APR 24150

Order Type: Single Limit

Quantity: 75 (1 lot)

Want to customize you entry? Check out our Entry Panel Guide

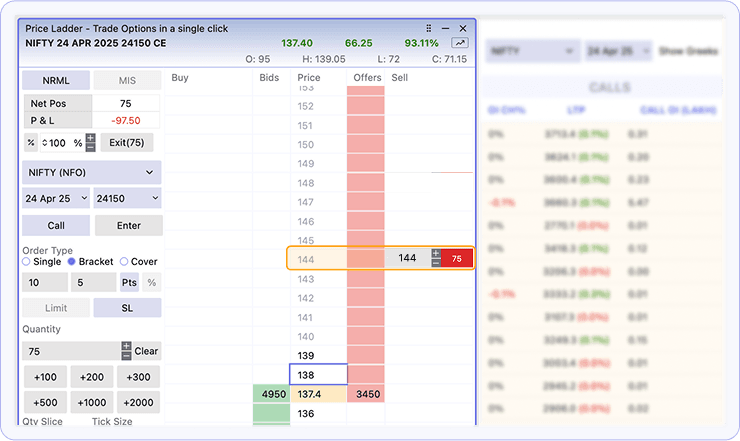

4. Place Limit Order

Step 1: To place Buy Oder click on any price in the Bid column.

Example: Clicking on the bid near ₹124 places a buy order for 75 quantity of NIFTY 24 APR 24150 CE.

Great — your order is placed!

And you’ve got the fill!

Similarly you can place sell order in the Click on any price in the Offer column to place a Sell order.

5. Exit Your Position

Step 1: Click on Exit to sell the order — either partially or fully

Step 2: Or simply place a reverse order using the ladder (Sell if you bought, Buy if you sold).

Congratulations! 🎉 You just exited with a 20-point profit in a bullish move! Welcome to smarter options trading with OptionX