Are you an options trader in India looking for a structured approach to F&O trading? The OptionX 143 Trading Strategy, popularized by Prakshal Gangwal, offers a methodical way to execute option selling strategies. This blog post will delve into the strategy, illustrating how you can leverage it with tools available on platforms like OptionX to manage risk and potentially enhance returns.

Understanding the OptionX 143 Trading Strategy

The core principle of the 143 Trading Strategy is to capitalize on market conditions by executing a safe and easy option selling strategy. It uses a predefined target and stop-loss via bracket orders, or an automatically trailing stop-loss, all at the combined strategy premium level. This makes it suitable for traders, scalpers, and day traders operating in the Indian F&O market.

Strategy Configuration: A Bank Nifty Example

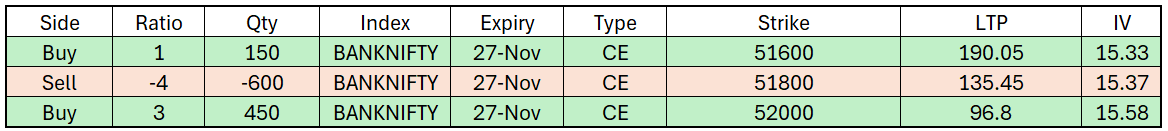

Let’s illustrate with a practical example using Bank Nifty.

- Underlying: Nifty Bank (Assume Current Price: 51135)

- Quantity: 150 (10 Lots - reflecting common lot sizes for Indian traders)

- Legs: 3 Out-of-the-Money (OTM) legs at 500, 700, and 900 points away from the At-The-Money (ATM) strike price.

The combined net premium (sum of Ratio*LTP) might be around -₹61.35. This means the premium collected (₹61.35 * 150) is approximately ₹9,202. This premium represents your initial profit buffer.

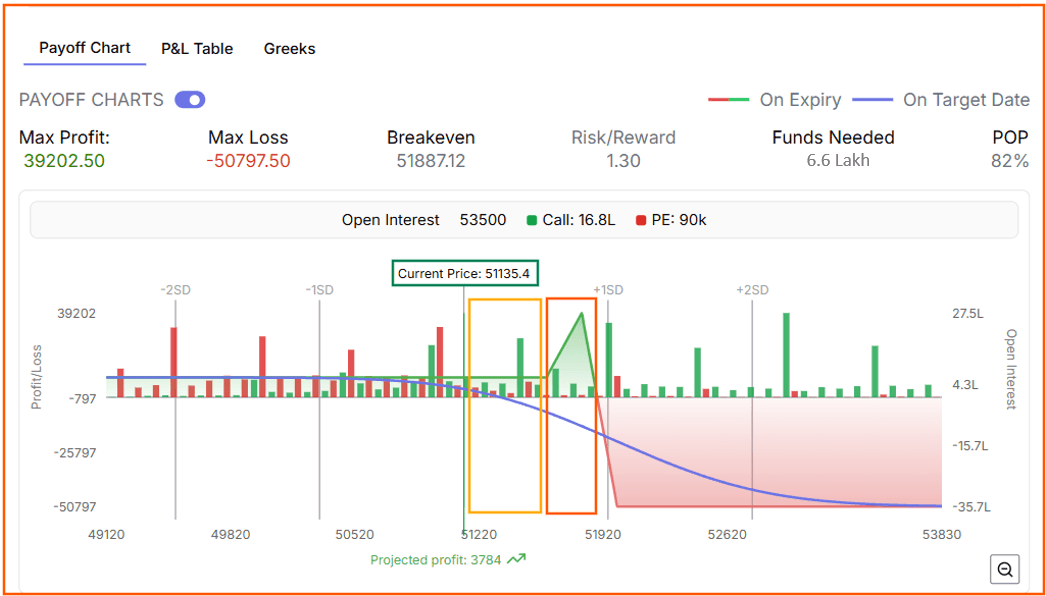

Payoff Diagram and Risk Management

A key aspect of the 143 strategy is understanding the payoff diagram. It typically features buffer zones where the strategy remains profitable even if the market moves against you within a certain range.

The diagram shows two safe buffer zones (represented as yellow and orange boxes). You can see how far Bank Nifty can rise before the strategy starts to lose money. Zone 1 represents a fixed profit, while Zone 2 can offer maximum profit potential within a specific range.

Favorable Market Conditions for the 143 Strategy

This strategy is most effective under the following conditions:

- Buffer Zone: Maintaining a buffer of at least 500 points away from the ATM strike price.

- Expiry: Utilizing 0DTE or 1DTE options for faster theta decay. This is crucial for maximizing profit within a shorter timeframe, common in Indian markets.

- Market Trend: Ideal for downward trending or sideways markets.

- Risk Mitigation: The buffer zones provide protection if the market rises, allowing time to adjust or exit the trade.

- Capital Efficiency: Relatively low capital requirement due to the hedging nature of the strategy.

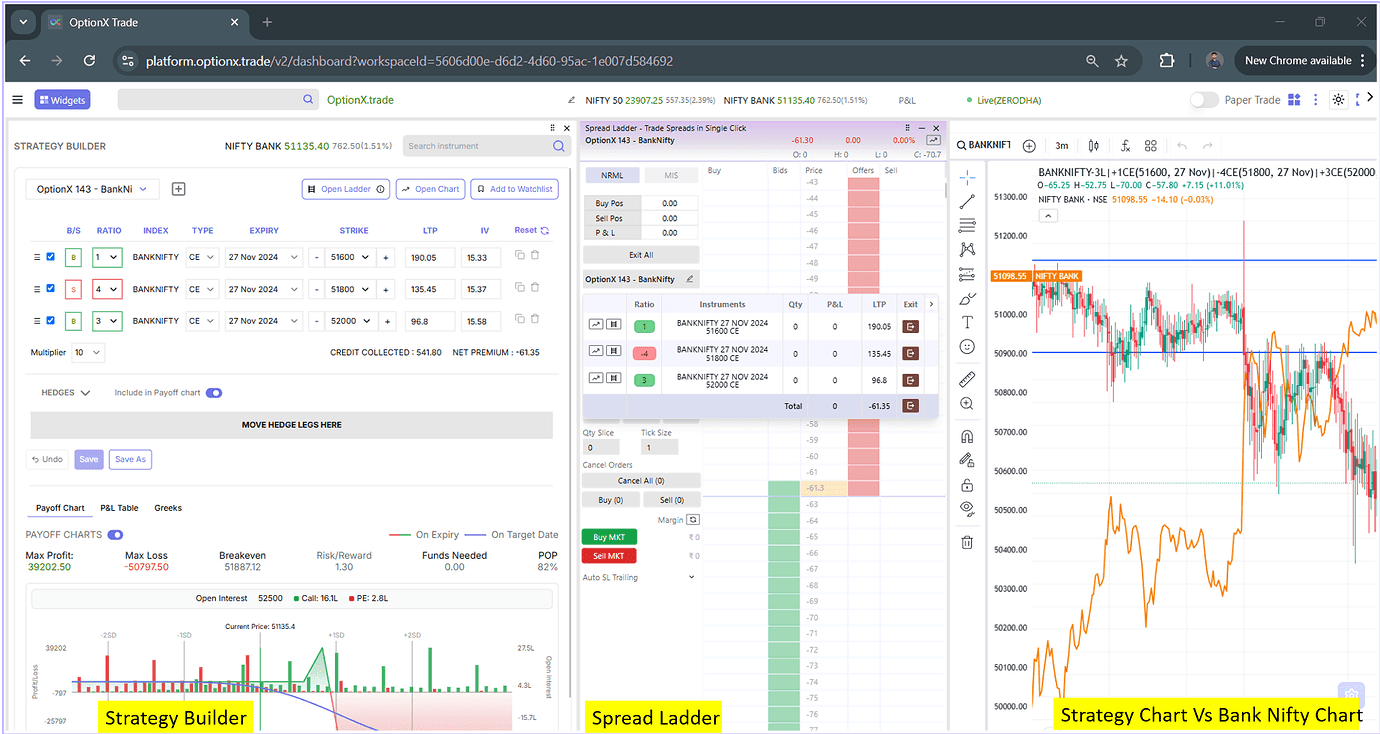

Execution Methods on OptionX

The OptionX platform provides tools to efficiently execute and manage the 143 strategy.

Method 1: Jobbing – Scalping the Premium

This method involves profiting from small fluctuations in the combined premium of the strategy.

Objective: Capture 10-15 points on each trade at the strategy level, repeating 3-4 times a day. This can translate to significant gains when trading in lots of 150 or more, as is typical in Bank Nifty.

Steps:

- Use the strategy builder on OptionX to create and save the 143 strategy. Open the spread ladder for easy management.

- Select the OCO (bracket) order type and define target and stop-loss levels based on the strategy's net premium range. OptionX allows setting these at the combined strategy level, reducing slippage.

- Place a buy-side bracket order for the strategy at the lower price point of the combined net premium range.

- The predefined target and stop-loss ensure a controlled risk/reward ratio for each trade.

Method 2: Auto Stop Loss Trailing – Riding the Trend

This method aims to maximize profit when the market trends downward, causing all legs to become further OTM and decrease in value.

Objective: Maximize potential profit by letting the trade run until the options legs approach zero value.

Steps:

- Create and save the strategy using the OptionX strategy builder. Open the spread ladder.

- Place a Single-Limit order at a favorable price point.

- Set a Single-SL order 10 points below the entry price and activate the trailing stop-loss feature by clicking the trailing arrow on OptionX. This feature automatically adjusts the stop-loss as the price moves in your favor, protecting unrealized profits.

- OptionX allows you to manage trailing speed and even base it on MTM profit, adding layers of control.

Leveraging OptionX Features for the 143 Strategy

Here's how OptionX enhances the execution of the 143 strategy:

- Multileg Order Management: Place limit, stop-loss, or bracket orders at the multi-leg strategy level for greater control over combined premium and reduced slippage.

- Easy Adjustments: Quickly cancel, modify, adjust, or roll up/roll down strikes in one click, essential for adapting to changing market conditions.

- Simplified Trading: Manage multi-leg strategies as easily as scalping naked options, with a single-screen interface and customizable widgets.

- Advanced Order Types: Utilize OCO orders, cover orders, and auto SL trailing for automated risk management.

- Fast Execution: Benefit from OptionX's reliable and fast execution with less than 5ms latency.

- MTM Based Exits: Enable and disable MTM based exits for automated profit locking or loss cutting.

Benefits of the 143 Strategy with OptionX

- Control: Place orders at the combined premium level.

- Easy to manage: Cancel, modify or adjust legs quickly

- Peace of mind: Manage strategies easily as you are scalping naked options

Conclusion: Trade the 143 Strategy with One Click

The OptionX 143 Trading Strategy offers a structured and potentially profitable approach to F&O trading, especially when combined with the advanced tools available on OptionX. Whether you're jobbing for small gains or riding a trend, the platform provides the flexibility and control you need. Benefit from features like the strategy builder, spread ladder, and auto SL trailing to efficiently manage your trades.

Ready to put the OptionX 143 Trading Strategy into action? Explore OptionX today and discover how its one-click execution, reliable platform, and comprehensive features can empower your options trading journey.

OptionX offers a lifetime free paper trading platform, allowing you to test and refine your strategies without risking real capital. Take advantage of this opportunity to master the 143 strategy and other techniques.

Disclaimer: The thoughts shared here are for educational purposes only. Trading involves risk, and you should carefully consider your risk tolerance and consult with a financial advisor before making any investment decisions.

If you found this information valuable, let us know, and we’ll bring you more such posts! Learn more about OptionX features.