In the dynamic world of options trading, particularly in the fast-paced Indian F&O market involving Nifty and Bank Nifty, success isn't solely about picking the right strategy. It's about mastering risk management. Whether you're an experienced options seller or new to ladder-based trading, understanding and implementing robust risk management techniques is paramount. This article will explore why risk management reigns supreme, regardless of your trading strategy.

The Three (or Four?) Outcomes of Every Trade

Every time you enter a trade, there are a limited number of potential outcomes:

- Outcome 1: The Stop-Loss Hit. The price moves against you, triggering your stop-loss. You incur a loss.

- Outcome 2: Profit! The price moves in your favor, allowing you to manage a profitable position. You win.

- Outcome 3: Sideways Action. The price stagnates, neither hitting your stop nor generating significant profit.

- Outcome 4: The Reversal (and Holding). The price initially moves in your favor, tempting you to hold without a clear target. Then, it reverses, eroding profits, and potentially turning into a loss as you stubbornly hold on, hoping for a rebound.

Realistically, outcome 3 often leads to minimal gains or losses, offering an opportunity to exit before substantial damage occurs. However, options traders must be wary of theta decay, especially with shorter expiry options. This reinforces the need for longer expiry options and robust risk management.

The 50/50 Illusion and the Power of Risk/Reward

Let's assume a hypothetical 50% chance of winning any given trade. This might seem favorable, but raw probability is insufficient for consistent profitability. The key lies in optimizing your entries to minimize risk when your trade thesis is invalidated. Consider shorting a double top after a significant wick formation, perhaps near the previous day's high. Enter short with a tight stop-loss just above the wick. If the price breaches that level, your thesis is invalidated, and you exit with a small, controlled loss. This is low-risk trading.

However, if the price declines, you've achieved a "sniper entry" with a potentially exceptional risk/reward ratio (1:4 or better). This is where risk management transforms a simple probability into a profitable strategy. Even with a win rate slightly below 50% (say 40-45%), disciplined risk management can lead to substantial profitability.

The Importance of Tight Stops and Accurate Price Action Reading

If you consistently require wide stop-losses, it's a sign of misinterpreting price action or entering trades impulsively ("FOMOing"). Address these issues first. Improve your understanding of market dynamics and refine your entry techniques to reduce the need for excessively wide stops.

Common Trading Mistakes and How to Avoid Them

Several common trading mistakes can sabotage even the best strategies. These include:

- Holding Losing Trades Too Long: Hope is not a strategy. Accept losses and move on.

- Ignoring Initial Profits and Letting Them Turn to Losses: Protect your profits by moving your stop-loss to breakeven or using profit trailing techniques.

- Lack of a Defined Exit Strategy: Enter every trade with a clear understanding of your profit target and maximum acceptable loss.

- Slippage: Be mindful of slippage, especially during volatile market conditions. Using limit orders can help mitigate this risk.

Leveraging Technology for Effective Risk Management

Modern trading platforms offer tools that can significantly enhance your risk management capabilities. For example, OptionX provides several features designed to help traders manage risk effectively:

- One-Click Order Execution: Enables rapid entry and exit, crucial for reacting quickly to market changes.

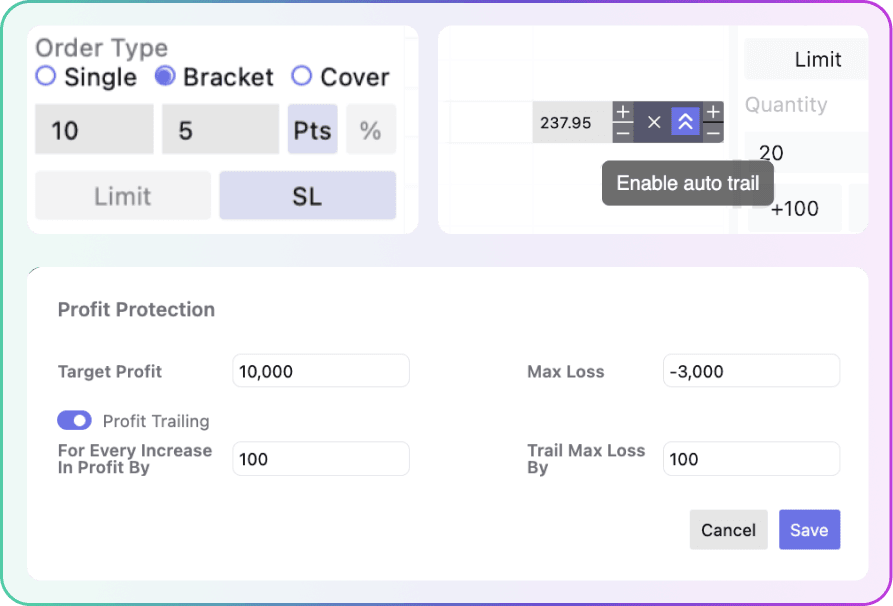

- Auto SL Trailing: Automatically adjusts your stop-loss as the price moves in your favor, locking in profits and minimizing potential losses. You can manage trailing speed to suit your risk tolerance.

- MTM Based Exits: Exits positions based on pre-defined Mark-to-Market (MTM) profit or loss levels. You can enable and disable MTM based exits as needed.

- Bracket Orders and Cover Orders: Automate your entry and exit points with pre-defined stop-loss and target levels.

- OCO (One Cancels the Other) Orders: Place two orders simultaneously – if one is triggered, the other is automatically cancelled.

- Fast and Reliable Execution (<5ms Latency): Minimizes slippage and ensures your orders are filled at the desired price.

These features, combined with OptionX's single-screen interface and widgets, provide a comprehensive environment for managing risk in the F&O market. The price ladders, spread ladder, Option Chain, and strategy builder are other useful tools for making informed decisions.

The OptionX Advantage: A Case Study in Risk Management

Imagine you're employing a ladder-based strategy on Bank Nifty. Using OptionX, you can quickly set up bracket orders to define your risk and reward parameters. The auto SL trailing feature then dynamically adjusts your stop-loss as the trade moves in your favor, protecting your profits. If market volatility spikes, the MTM-based exits can automatically close your position, preventing substantial losses. Platforms like Zerodha, Dhan, Fyers, and Angel One also offer risk management tools, but OptionX's focus on speed, reliability, and integrated features makes it a compelling choice for options traders.

Conclusion: Risk Management - The Cornerstone of Trading Success

Trading success, especially in the volatile Indian F&O market, hinges on effective risk management. It's not about winning every trade; it's about maximizing profits when you're right and minimizing losses when you're wrong. By adopting sound risk management principles and leveraging the tools available on platforms like OptionX, you can significantly increase your chances of long-term profitability.

Ready to take your risk management to the next level? Explore OptionX's lifetime free paper trading platform and discover how its features can empower your trading strategy. Start your journey to becoming a more disciplined and profitable trader today!