What Exactly is a Price Ladder?

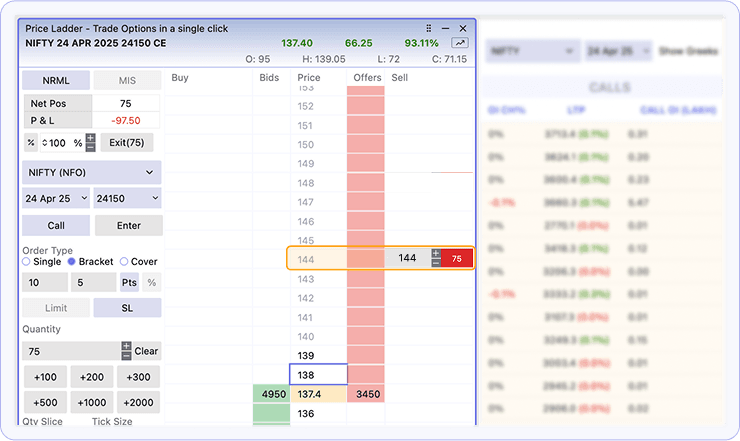

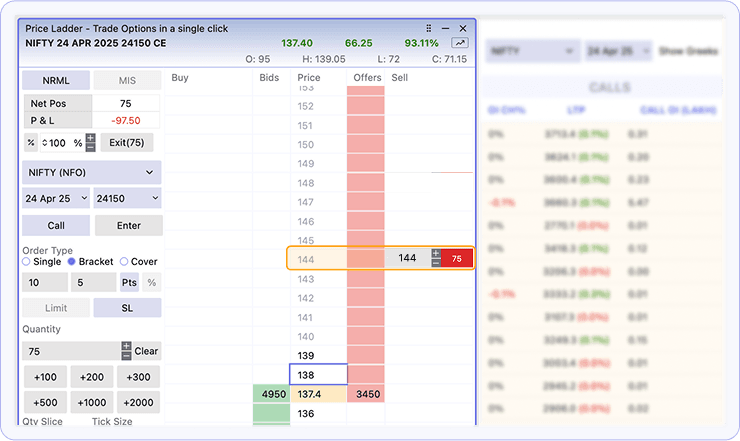

At its core, a Price Ladder, sometimes known as a Market Ladder or Depth of Market (DOM), is a vertically oriented trading interface that displays live price levels, bid and ask volumes, and your active orders in real-time. Instead of just showing the last traded price, it exposes the liquidity sitting at each price point, offering a granular view of market supply and demand.

Imagine it as a real-time “X-ray vision” into the market’s order book. Each rung of the ladder represents a price level, and alongside it, the volume of buy and sell orders waiting to be matched. Traders can place, modify, or cancel orders simply by clicking on these price levels, making it one of the most dynamic and precise ways to interact with the market.

This tool is indispensable for traders who rely on speed and depth of information to make decisions, from day traders capturing tiny price movements to options traders managing complex multi-leg strategies.

A Brief History of Price Ladder Trading

The concept of viewing market depth isn’t new. It dates back to the open outcry trading pits on exchanges where traders physically saw bids and offers on the floor. As electronic trading took over in the late 20th century, this visibility transitioned into digital form through Depth of Market windows.

Initially, these tools were simple, showing limited order book levels and requiring manual input for orders. Over the years, advancements in trading technology, data speeds, and user interface design have transformed price ladders into highly interactive platforms that can handle vast amounts of market data instantly.

In the 2000s, professional futures and options traders began leveraging sophisticated ladder tools for ultra-fast execution and order management, especially in high-frequency environments. Today, price ladders are a standard feature in many professional trading terminals worldwide.

Current Advancements with OptionX — Bringing Price Ladder Trading to the Next Level

OptionX is at the forefront of innovating Price Ladder Trading for Indian options markets, integrating advanced features and multiple ladder types tailored specifically for options traders.

Unlike generic ladders, OptionX’s ladders are built with the nuances of options trading in mind, offering a seamless blend of precision, speed, and strategic flexibility.

Types of Price Ladders on OptionX

1. Price-Based Ladder

This ladder moves dynamically with the selected option’s price, allowing traders to place orders with tick-level accuracy. It’s perfect for those focused on premium fluctuations and requires real-time, granular control over individual option contracts.

2. Index-Based Ladder

Linked to the underlying index (like Nifty or BankNifty), this ladder helps traders track how option premiums react to shifts in the index price. It’s ideal for scalping or hedging strategies where index correlation is key.

3. Strategy-Based Ladder

A standout feature for options traders, this ladder consolidates multiple legs of an options strategy (straddles, spreads, iron condors) into a single interface. It enables linked execution and real-time spread tracking, making complex strategies easier to manage and adjust.

Beyond these, OptionX ladders come with drag-and-drop order modifications, one-click bracket and cover orders, and integrated charts tools that dramatically reduce the time from decision to execution while enhancing risk management.

Why is Price Ladder Trading So Useful for Options Traders?

Options trading involves managing multiple parameters: strike prices, expiries, premiums, and complex multi-leg strategies. The Price Ladder provides a visual and interactive way to keep all these moving parts in view and under control.

- Visualizing Liquidity: Options can have fragmented liquidity. Seeing the bid and ask sizes at each price helps traders identify the best entry and exit points.

- Speed of Execution: Option prices can move quickly, especially near expiry. Ladder trading lets traders place or adjust orders with a single click, shaving precious milliseconds off execution time.

- Multi-Leg Strategy Management: Strategy ladders simplify handling complex positions by showing all legs and their interactions, reducing errors and improving trade adjustments.

- Risk Management: Features like bracket orders and auto stop-loss placement directly from the ladder allow better protection against sudden market moves.

For options traders, where timing and precision matter as much as strategy, price ladders transform the trading experience from reactive to proactive.

How Does OptionX Compare with Other Price Ladder Tools?

While price ladders have been around for decades, many platforms offer generic or overly complex versions that don’t fully cater to the needs of options traders, especially in the Indian market.

- Speed and Responsiveness: OptionX ladders are built on a low-latency infrastructure optimized for Indian derivatives, providing near-instant order execution.

- Strategy Integration: Unlike most ladders that focus on single contracts, OptionX offers dedicated strategy-based ladders, a feature rare in competing platforms.

- User Experience: The interface is clean, customizable, and designed for ease of use without sacrificing advanced functionality, unlike cluttered or overly technical ladders on some platforms.

- Risk Tools: Built-in bracket orders, auto SL, and cover order placements are integrated seamlessly into the ladder interface, enhancing safety without complicating the UI.

While other platforms may offer ladder trading primarily for futures or equities, OptionX’s specialized focus on options trading gives it a distinct edge for derivative traders.

How to Use Price Ladder Trading for Free?

For traders looking to experience price ladder trading without upfront costs, OptionX offers a free 14-day trial mode and a lifetime free paper trading feature. This allows you to:

- Explore all ladder types with live market data simulation.

- Practice placing, modifying, and exiting orders without risking real money.

- Build familiarity with multi-leg strategy ladders in a risk-free environment.

Additionally, some brokers and platforms may offer limited ladder features in their free or basic plans, but these often lack the depth and speed that OptionX provides.

Starting with OptionX’s free tools is an excellent way to master ladder trading fundamentals before scaling to live markets.

Conclusion

The Price Ladder is more than just a trading tool, it’s a window into the heart of market dynamics, bringing unprecedented transparency, speed, and control. Its evolution from basic order book viewers to complex, strategy-integrated interfaces mirrors the increasing sophistication of today’s options traders.

OptionX is redefining the price ladder experience in India by delivering advanced ladder types, ultra-fast execution, and intuitive risk management tailored specifically for options trading. Whether you’re a beginner looking to learn order flow or a pro managing multi-leg strategies, mastering price ladder trading is essential to trading smarter in 2025.

Experience The Future of Option Trading with OptionX Price Ladder, where every click counts.