A Cover Order is a two-legged order:

- The entry leg is a Market order for instant execution

- The exit leg is a Stop-Loss Order which is mandatory at the time of placing the trade

Since stop-loss is pre-defined, brokers allow higher leverage on Cover Orders compared to other types.

Place Cover Orders

A Cover Order is a fast-execution order with a compulsory stop-loss. You enter a trade with a built-in SL, which helps limit your risk from the moment the order is placed.

Why Use Cover Orders?

- Extremely useful for scalping and high-speed trades.

- Protects capital by forcing a stop-loss.

- Requires lower margin, as risk is predefined.

You cannot place a Cover Order without specifying a stop-loss, making it an excellent tool for disciplined trading.

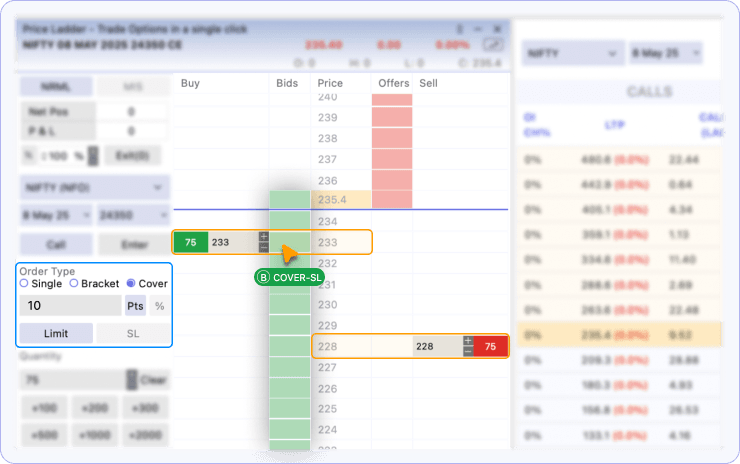

How to Place a Cover Limit Order on OptionX:

Step 1: Navigate to the Price Ladder.

Step 2: Select Cover and Limit in Order Type inside the Entry Panel.

Step 3: Enter Stop-Loss Points (How much below the entry price you want to exit)

Step 4: Click on the Bid column below the LTP price to place Buy order.

Step 5: Click on the Offer column above the LTP price to place Sell order.

How to Place a Cover Stop Loss Order on OptionX:

Step 1: Navigate to the Price Ladder.

Step 2: Select Cover and Limit in Order Type inside the Entry Panel.

Step 3: Enter Stop-Loss Points (How much below the entry price you want to exit)

Step 4: Click on the Bid column above the LTP price to place Buy order.

Step 5: Click on the Offer column below the LTP price to place Sell order.